Donation Tax Receipt Template

Create donation receipts online now. A daycare receipt is similar to ordinary standard receipts.

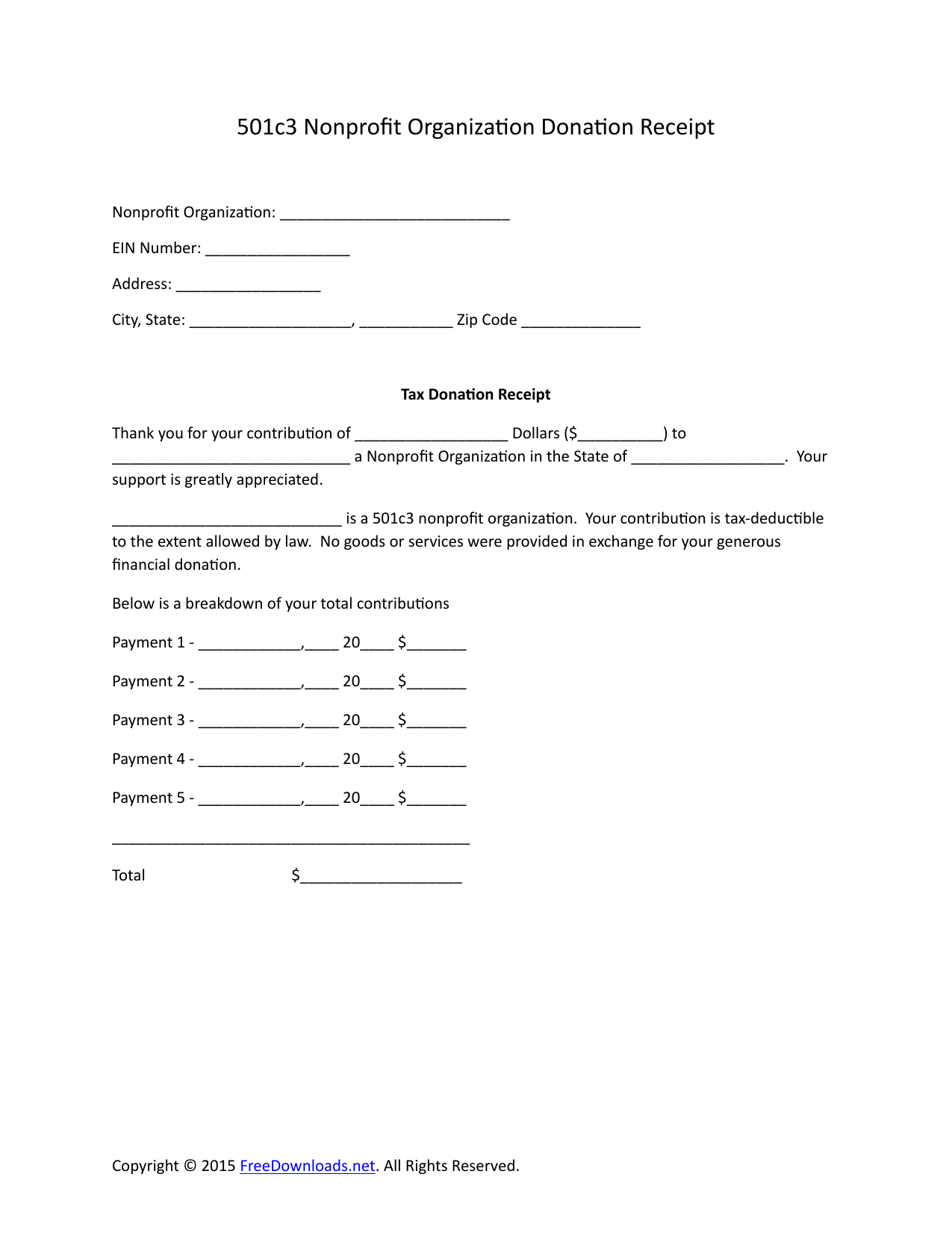

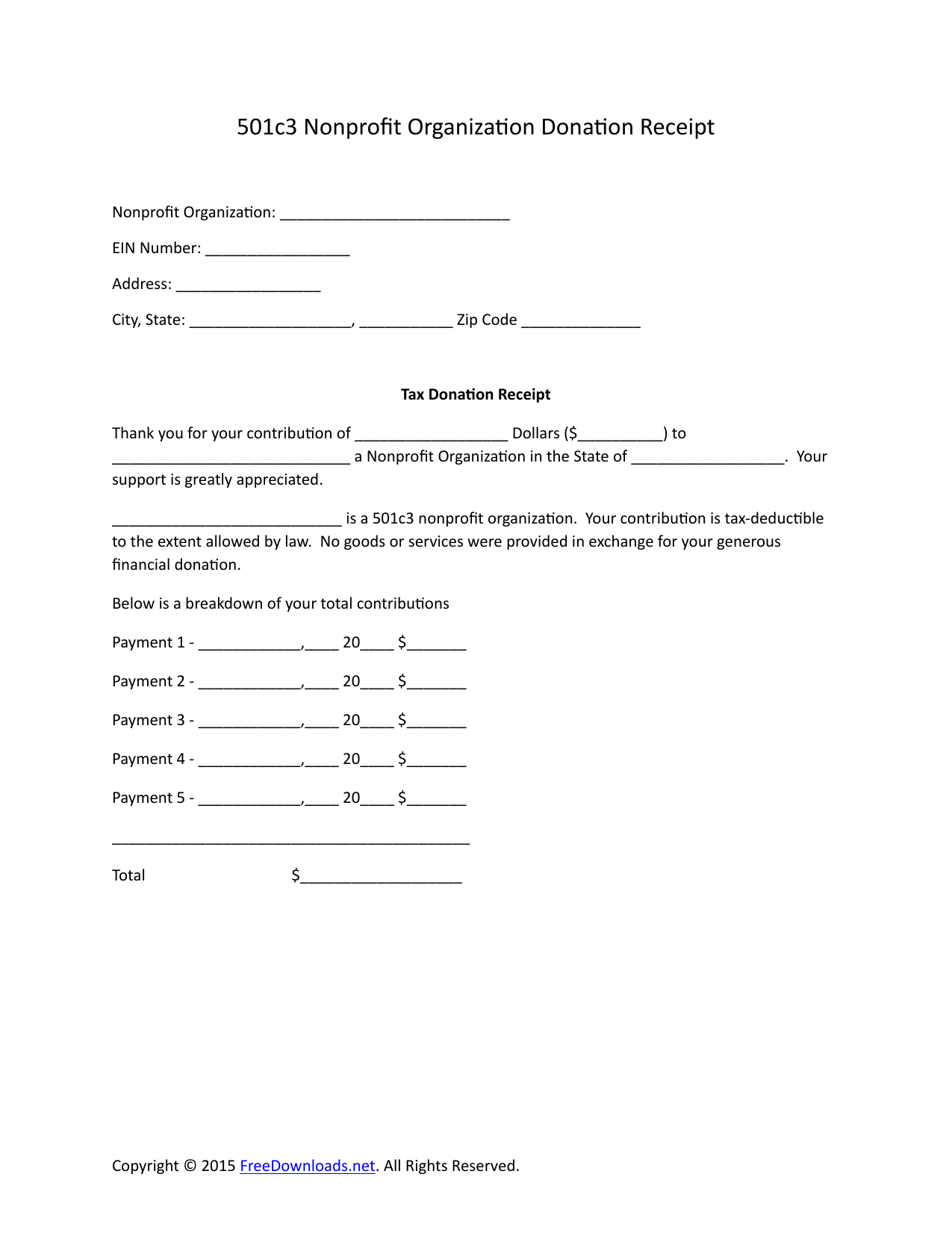

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Offer valid for tax preparation fees for new clients only.

. An itemized restaurant receipt in Apple Pages is a type of receipt template that follows a simple format. You do not need Microsoft Word Excel or any. A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their State andor Federal taxes.

Edit the invoice template to include the specific project details. Since donated clothing is often secondhand it is up to the donor to estimate the clothings values. The Donation Acknowledgement Letter is a basic way you can confirm and affirm a monetary gift to your church.

When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. In addition Goodwills name Goodwill Retail Services Inc store address and. The IRS will require proof of every charitable transaction and the donation receipt is that proof.

These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. A tax deductible donation letter is a formal written request for donations from individuals companies or organisations. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return.

Dear first name I want to personally thank you for your donation of gift amount to church name. When you do this make sure not to abuse the privilege by overvaluing items. This letter is your receipt for income tax purposes.

Before we dive in check out our online invoice generator for an easy way to create an invoice for your projects that will look fantastic. All donors who are looking for a solid charity to donate to. A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization.

Simple Receipt VS Daycare Receipt. The consequence of this is to get audited. It follows the format of listing the date of the transaction the name of the vendor the item being purchased and the cost of the items.

Remember to include the following information. A goods receipt template can take on many forms and may contain a variety of different things. Also the person who is in charge of collecting.

The letter conveys the reader a message that he can be a beneficiary of many tax benefits after giving donations to poor people. Make sure to save your donation receipt template so you can make use of the same template for all your donations. Registered nonprofit organizations can issue both official donation.

Standard guidelines such as a fixed percentage of an items original. Please consult your tax advisor to determine deductibility of this contribution. Sending these is standard practice in church and nonprofit culture.

This letter provides the potential donor with information about the requesting organisation. XXX The serial number of the receipt. Thanking your donors for their contributions and letting them know how grateful you are for their support is a key element of successful church donation letters.

One great benefit you can get from a charitable donation receipt is that you can use it to claim a tax deduction for household property and clothing that you may itemize in your taxes. A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. Updated July 29 2022.

This is sometimes also a preferred choice in some food joints hotels and restaurant establishments. May not be combined. By providing receipts you let your donors know that their donation was received.

Moreover a receipt is always useful for tracking the donations and donors. Donation receipt template 23 105 KB donation receipt template 24. Get started creating the perfect template for your charity with our online receipt maker today.

Updated June 03 2022. Each receipt must. A member of the management staff must verify that the donation receipts match the completed form and fill in the date of donations in this section.

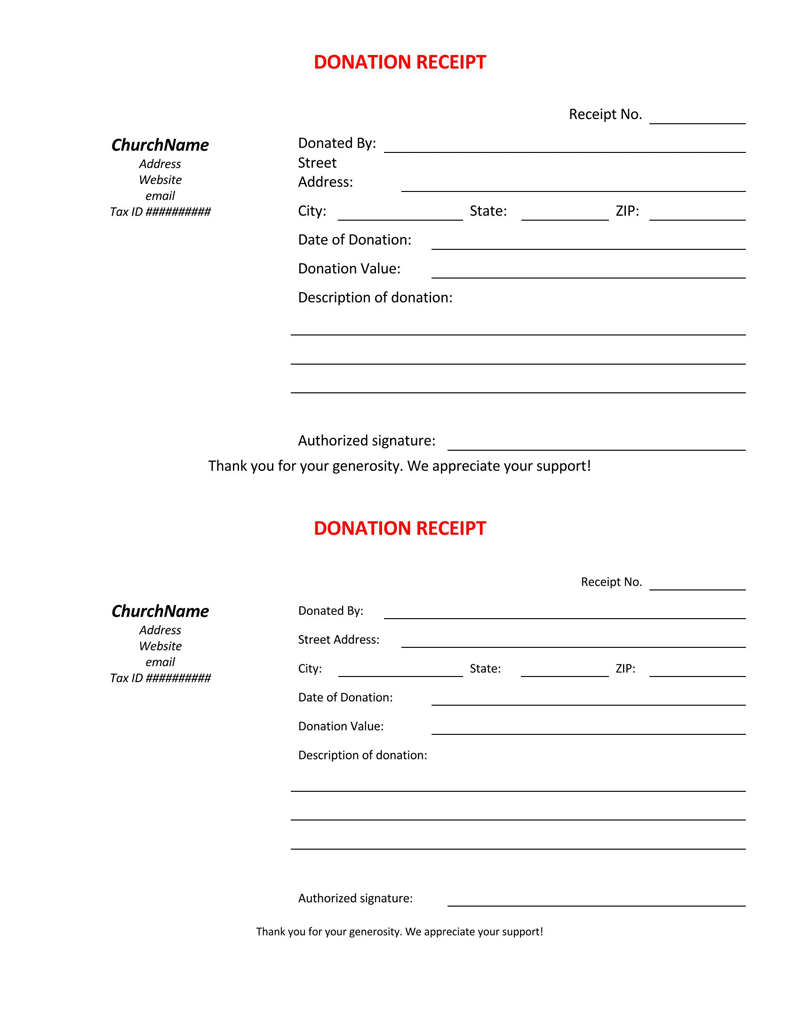

Contributions to organizations with 501c3 status may be tax deductible. Further this helps you can maintain a strong relationship with your congregation and. This Church Donation Receipt PDF template can be used for providing receipts to the donor for the donations they made.

You as the donor will place value on the donated goods. The form and instructions are available on the IRS site and can be accessed through this link IRS Tax Forms. This blank rent receipt template allows you to print three rent receipts per A4 or letter paper.

Still it differs in the instead of including a description of the itemproduct. How to Create a Goods Receipt Template. If the IRS qualifies the organization receiving the donation as having tax-exempt status the donation receipt is then used to claim a deduction on the donors income tax return.

Were honored you would. Once youve found an Excel template to suit your business needs click on the template to open a preview page. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction.

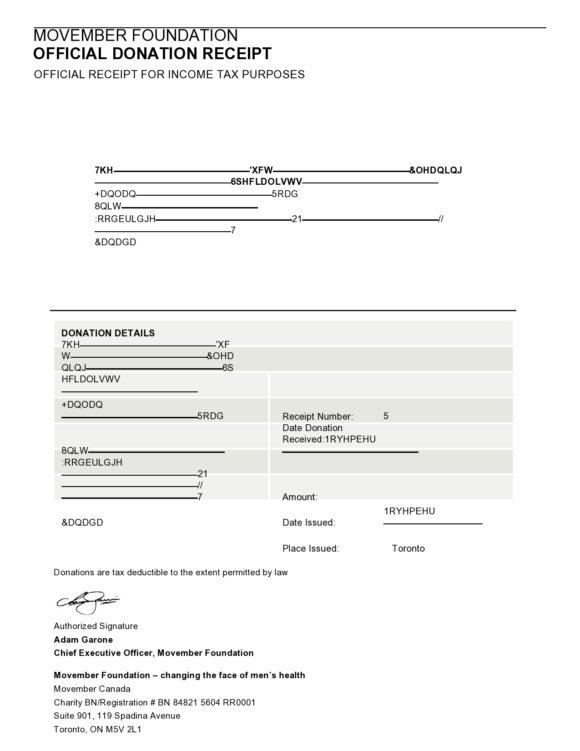

A good goods receipt template is one that appropriate for the types of goods listed and applicable for use for that particular transaction. Official donation receipt for income tax purposes A statement that identifies the form as an official donation receipt for income tax purposes. We can help you with the creation of a donation receipt template so you can easily send a receipt to all of your donors.

SOC is recognized as a tax-exempt organization under section 501c3 of the Internal Revenue Code. This helps your church members to feel valued and involved in the work your church is doing. It bears relevant information about the services such as the name of the child information about the daycare center tax deduction etc.

It acknowledges that a gift was made to you and that the receipt contains the information required under the Income Tax Regulations. Also make a copy and file all the donation receipts which you have given out to keep track of all the donations and for tax purposes as well. A donation receipt is an important document that serves as a verification and proof of the donation.

In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. All you need is a PDF reader that is freely available on the internet eg Acrobat Reader and Foxit PDF reader. Then click the Create button to open it as a new spreadsheet.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Here are some simple steps that you can follow to create a simple yet.

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Free Donation Receipt Templates Samples Word Pdf Eforms

Download 501c3 Donation Receipt Letter For Tax Purposes Pdf Rtf Word Freedownloads Net

Donation Receipt Template Pdf Templates Jotform

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Template 501 C 3 Word Pdf Eforms